Which THREE of the following statements about stock market listings are correct?

A company has two divisions.

A is the manufacturing division and supplies only to B, the retail division.

The Board of Directors has been approached by another company to acquire Division B as part of their retail expansion programme.

Division A will continue to supply to Division B as a retail customer as well as source and supply to other retail customers.

Which is the main risk faced by the company based on the above proposal?

A manufacturing company based in Country R. where the currency is the R$, has an objective of maintaining an operating profit margin of at least 10% each year

Relevant data:

• The company makes sales to Country S whose currency is the SS It also makes sales to Country T whose currency is the T$ " All purchases are from Country U whose currency is the US.

• The settlement of an transactions is in the currency of the customer or supplier

Which of the following changes would be most likely to help the company achieve its objective?

Three companies are quoted on the New York Stock Exchange. The following data applies:

Which of the following statements is TRUE?

A listed company plans to raise $350 million to finance a major expansion programme.

The cash flow projections for the programme are subject to considerable variability.

Brief details of the programme have been public knowledge for a few weeks.

The directors are considering two financing options, either a rights issue at a 20% discount to current share price or a long term bond.

The following data is relevant:

The company's share price has fallen by 5% over the past 3 months compared with a fall in the market of 3% over the same period.

The directors favour the bond option.

However, the Chief Accountant has provided arguments for a rights issue.

Which TWO of the following arguments in favour of a right issue are correct?

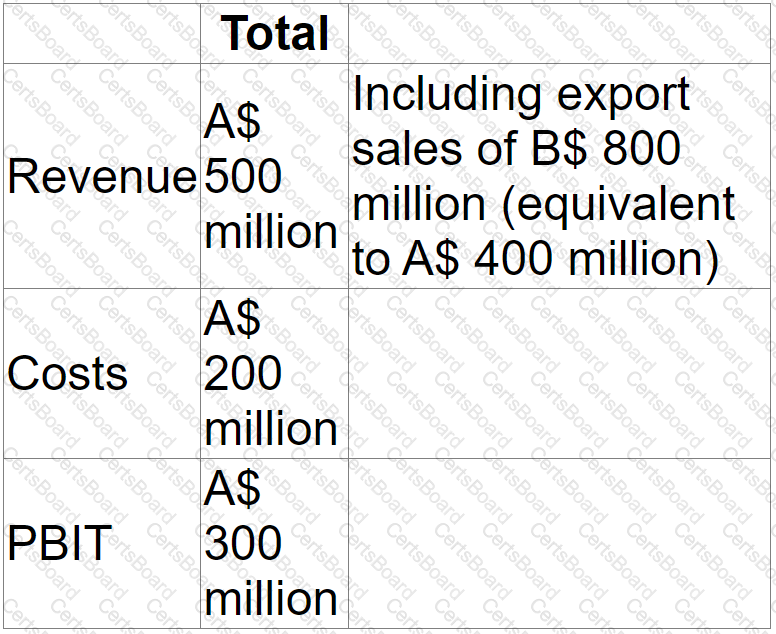

A company aims to increase profit before interest and tax (PBIT) each year.

The company reports in A$ but has significant export sales priced in B$.

All other transactions are priced in A$.

In 20X1, the company reported:

In 20X2, the only changes expected are:

• An increase in export prices of 10%, but no change to units sold.

• A rise in the value of the B$ to A$/B$ 2.500 (that is, A$ 1 = B$ 2.5)

Is it likely that the company would still meet its objective to grow PBIT between 20X1 and 20X2?

NNN is a company financed by both equity and debt. The directors of NNN wish to calculate a valuation of the company's equity and at a recent board meeting discussed various methods of business valuation.

Which THREE of the following are appropriate methods for the directors of NNN to use in this instance?

Company A is a large listed company, with a wide range of both institutional and private shareholders.

It is planning a takeover offer for Company B.

Company A has relatively low cash reserves and its gearing ratio of 40% is higher than most similar companies in its industry.

Which TWO of the following would be the most feasible ways of Company A structuring an offer for Company B?

Company ABC is planning to bid for company DDD, an unlisted company in an unrelated industry sector to ABC.

The directors of ABC are considering a number of different valuation methods for DDD before making a bid.

Which of the following is the MOST appropriate method for ABC to use to value DDD?

A company wishes to raise new finance using a rights issue. The following data applies:

• There are 20 million shares in issue with a market value of $6 each

• The terms of the rights will be 1 new share for 4 existing shares held

• After the rights issue, the theoretical ex-rights price (TERP) will be $5.75

Assuming all shareholders take up their rights, how much new finance will be raised ?

Give your answer to one decimal place.

$ ? million