A company has 6 million shares in issue. Each share has a market value of $4.00.

$9 million is to be raised using a rights issue.

Two directors disagree on the discount to be offered when the new shares are issued.

• Director A proposes a discount of 25%

• Director B proposes a discount of 30%

Which THREE of the following statements are most likely to be correct?

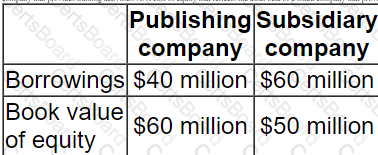

A listed publishing company owns a subsidiary company whose business activity is training.

It wishes to dispose of the subsidiary company.

The following information is available:

The board of the publishing company believe that the value of the subsidiary company, and hence the value of the equity invested in it, can be determined by calculating the present value of the subsidiary's free cashflows.

Which of the following is the most appropriate discount rate to use when determining the enterprise value of the company?

F Co. is a large private company, the founder holds 60% of the company's share capital and her 2 children each hold 20% of the share capital.

The company requires a large amount of long-term finance to pursue expansion opportunities, the finance is required within the next 3 months. The family has agreed that an Initial Public Offering (IPO) should not be pursued at this time, because it would take up to 12 months to arrange.

The existing shareholders are currently considering raising the required finance from an established Venture Capitalist in the form of debt and equity. The Venture Capitalist has agreed to provide the required finance provided it can earn a return on investment of 25% per year. In addition, the Venture Capitalist requires 60% of the equity capital, a directorship in the company and a veto on all expenditure of a capital or revenue nature above a specified limit.

From the perspective of the family, which of the following are advantages of raising the required finance from the Venture Capitalist?

Select all that apply.

A large, listed company in the food and household goods industry needs to raise $50 million for a period of up to 6 months.

It has an excellent credit rating and there is almost no risk of the company defaulting on the borrowings. The company already has a commercial paper programme in place and has a good relationship with its bank.

Which of the following is likely to be the most cost effective method of borrowing the money?

Company A is proposing a rights issue to finance a new investment. Its current debt to equity ratio is 10%.

Which TWO of the following statements are true?

A consultancy company is dependent for profits and growth on the high value individuals it employs.

The company has relatively few tangible assets.

Select the most appropriate reason for the net asset valuation method being considered unsuitable for such a company.

Company A needs to raise AS500 mi lion to invest in a new project and is considering using a pub ic issue of bonds to finance the investment.

Which THREE of the following statements-relating to this bond issue are true?

An unlisted company.

• Is owned by the original founders and members of their families

• Pays annual dividends each year depending on the cash requirements of the dominant shareholders.

• Has earnings that are highly sensitive to underlying economic conditions.

• Is a small business in a large Industry where there are listed companies with comparable capital structures

Which of the following methods is likely to give the most accurate equity value for this unlisted company?

The Treasurer of Z intends to use interest rate options to set an interest rate cap on Z’s borrowings.

Which of the following statement is correct?

A company plans to raise $12 million to finance an expansion project using a rights issue.

Relevant data:

• Shares will be offered at a 20% discount to the present market price of $15.00 per share.

• There are currently 2 million shares in issue.

• The project is forecast to yield a positive NPV of $6 million.

What is the yield-adjusted Theoretical Ex-Rights Price following the announcement of the rights issue?