A venture capitalist is considering investing in a management buy-out that would be financed as follows:

• Equity from managers

• Equity from a venture capitalist

• Mezzanine debt finance from a venture capitalist

• Senior debt from a bank

The venture capitalist is planning to work with the management to grow the business in anticipation of an initial public offering within five years.

However, the cash forecast shows a potential shortage of funds in the first year and the venture capitalist is evaluating the potential impact of cash being generated in the first year being significantly lower than forecast.

The most important risk that a shortage of cash would create for the management buyout is that the new company has insufficient funds to:

Company R is a major food retailer. It wishes to acquire Company S, a food manufacturer.

Company S currently supplies many stores owned by Company R with food products that it manufactures.

Company S is of similar size to Company R but has a lower credit rating.

Which of the following is most likely to be a synergistic benefit to R on purchasing S?

Which of the following statements about the tax impact on debt finance is correct?

Which THREE of the following are likely to be strategic reasons for a horizontal acquisition?

The shares of a company in a high technology industry have been listed on a stock exchange for 10 years. During this period, it has paid no dividends but invested all retained earnings in growth. The company is now entering a period of relatively stable growth and the directors are considering beginning to pay dividends They are reviewing the following suggestions made by members of the board:

• Pay cash dividends linked to growth in earnings

• Use a residual theory approach to establish cash dividends

• Issue scrip dividends (shares instead of cash)

• Continue to pay no dividends as dividends are irrelevant to the value of the company

Which THREE of the following are correct statements for the directors to take into consideration when making a decision about future dividend policy?

A company gas a large cash balance but its directors have been unable to identify any positive NPV projects to invest in. Which THREE of the following are advantages of a share repurchase, compared with a one-off large dividend?

Company M plans to bid for Company J. Company M has 20 million shares in issue and a current share price of $10.00 before publicly announcing the planned takeover. Company J has 10 million shares in issue and a current share price of $4.00.

The directors of Company M are considering an all-share bid of 1 Company M shares for 2 Company J shares.

Synergies worth $20m are expected from the acquisition.

What is the likely change in wealth for Company M's shareholders (in total) if the bid is accepted?

Give your answer to the nearest $ million.

$ ? million

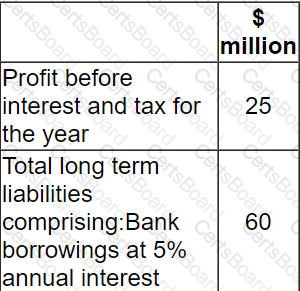

At the last financial year end, 31 December 20X1, a company reported:

The corporate income tax rate is 30% and the bank borrowings are subject to an interest cover covenant of 4 times.

The results are presently comfortably within the interest cover covenant as they show interest cover of 8.3 times. The company plans to invest in a new product line which is not expected to affect profit in the first year but will require additional borrowings of $20 million at an annual interest rate of 10%.

What is the likely impact on the existing interest cover covenant?

X exports goods to customers in a number of small countries Asia. At present, X invoices customers in X's home currency.

The Sales Director has proposed that X should begin to invoice in the customers currency, and the Treasurers considering the implications of the proposal.

Which TWO of the following statement are correct?

Company A has agreed to buy all the share capital of Company B.

The Board of Directors of Company A believes that the post-acquisition value of the expanded business can be computed using the "boot-strapping" concept.

Which of the following most accurately describes "boot-strapping" in this context?