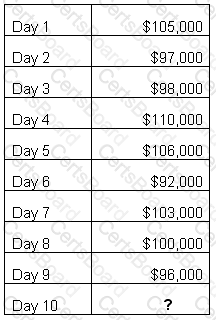

The treasury analyst for XYZ Corporation, a small retailer, is trying to forecast daily cash receipts being swept from the store depository accounts. The analyst has been given the data in the table regarding receipts from the last few days. The analyst chooses to use a seven-day simple moving average forecast methodology.

What is the amount that XYZ Corp. would expect to receive on Day 10 (rounded to the nearest whole $)?

An assistant treasurer discovers that the CFO has been allowing other executives to exercise stock options during blackout periods. What will prevent the assistant treasurer from losing his/her job if he/she reports this discovery?

Which of the following ways of financing accounts receivable requires a company to relinquish control of the type of customer to which it sells?

A United States company must remit a dollar royalty payment to its Japanese subsidiary. Cash settlement of the payment would typically be made by which of the following?

A company can dispute any check alterations within how many days after the bank statement has been sent?

A telecommunications company has decided to sell its call center hosting division. This is an example of what type of financial decision?

Which of the following would be used to evaluate only the effects of varying interest rates while holding all other values constant at their expected levels?