Company M operates a grocery distribution business on Main Street. As part of its business continuity plan, Company M intends to purchase insurance to cover the facility lease for its Main Street warehouse in the event it cannot operate for a period of time. What type of coverage should Company M purchase?

The board of directors announces an increase in its dividend from $0.11/share to $0.15/share. Over the next two quarters, management notices that its investor base has shifted to include a large percentage of pension funds and endowment funds. This is the result of:

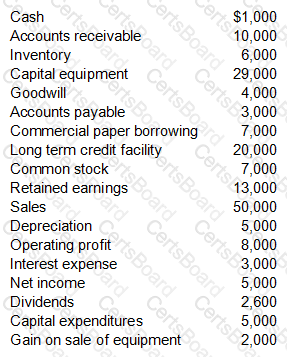

BF Company, a manufacturer of food products, reported financial information shown in the table below for the end of the year.

BF Company is subject to covenants under its revolving credit facility. It is in compliance with which of the following?

During the 1970s, many companies instituted dividend reinvestment plans (DRIPS). There are many benefits of this plan. What is the one negative aspect?

Company ABC has expanded its banking relationships due to international growth. ABC cannot figure out why its collection float amongst its international customers is longer than its domestic customers. Additionally, ABC is incurring significant costs related to the receipt and processing of these customer payments. ABC is MOST LIKELY experiencing issues related to:

Which of the following is the MOST accurate statement regarding the passage of the Sarbanes-Oxley Act?

A company has negotiated a credit facility with the following terms:

What is the effective annual borrowing rate for the line of credit?

A company invests in a bond and then later agrees to sell the bond to a bank with the understanding that the company will buy the bond back at a later time. This is known as:

What is the primary weakness of a risk management policy that includes risk control without specifically providing a plan for risk financing?