An internal auditor discovers that employees can enter and approve their own wire transfers. This practice violates what internal control?

An auto manufacturing plant in Michigan has high scheduled demand for its product. If the company does not have a long-term contract for raw materials, what type of exposure could it face?

Which of the following statements are true about collected balances?

I. They can be lower than ledger balances.

II. They are influenced by the bank's availability schedule.

III. They exclude negative account balances.

IV. They may generate an earnings credit.

The analysis of a company launching an initial public offering includes disclosure of information that may interest investors. It also includes confirmation that financial statements reflect true value under GAAP and other pertinent areas of a company’s operations. What is this analysis known as?

A measure of the incremental impact of a company's investments on market capitalization is known as:

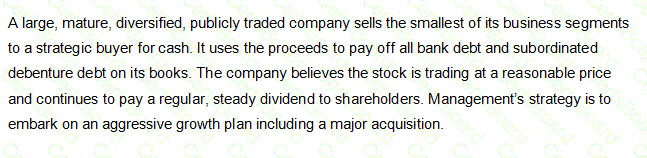

Based on the above information, before making the major acquisition, several large institutional shareholders have asked management to consider all of the following EXCEPT:

Which two of the following are optimal uses for short-term excess cash?

I. Pay down credit lines.

II. Make overnight investments.

III. Repurchase stock.

IV. Make capital expenditures.

A company offers credit terms of net 40, with an opportunity cost of 12% to a customer. What discount would have to be offered for the customer to be indifferent between paying on Day 40 and paying with the discount on Day 10?

A decrease in the accounts receivable from one period to the next is considered to be:

T-bill discount rate = 5.85%

T-bill face value = $100,000

Initial term = 90 days

If the U.S. Treasury was considering issuing a 91-day T-bill at the same time as this T-bill, what discount rate would cause both instruments to have the same purchase price?

A fast-food chain uses corn as an ingredient in its products and wants to hedge its price for corn purchases. It purchases a call option to buy 1,000,000 bushels at $4 per bushel. Assume that the company will pay a premium of $0.10 per bushel or $100,000 to get into the contract. Suppose the price of corn falls to $3.80 per bushel, what is the BEST course of action for the company?

Company A has operated a Pension Plan since 1985. Despite a recent surge in asset values, the plan remains significantly underfunded. With the passage of the Pension Protection Act of 2006, Company A will be need to:

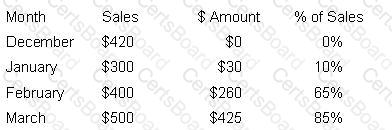

ACCOUNTS RECEIVABLE AT THE END OF MARCH

On the basis of the accounts receivable balance pattern above and April sales of $600, the cash flow forecast for April is:

According to the Capital Asset Pricing Model, which of the following would increase the required rate of return, given a beta of 1?

A commercial paper issuer who repays investors earlier in the day than it receives funds from new investors often creates which of the following?

Concerning the financial management function of a company, which organization sits at the center of the financial supply chain?

The MOST effective way to reduce the internal risk of technology as it relates to critical treasury functions is to: