Which of the following is a ratio that is often used by commercial banks to measure a company’s leverage and does not include the effect of assets that are difficult to value or are NOT easily converted to cash?

A call option for a company has an exercise price of $50. The stock is currently trading at $60. At maturity, what should an investor who paid $3 for the option do?

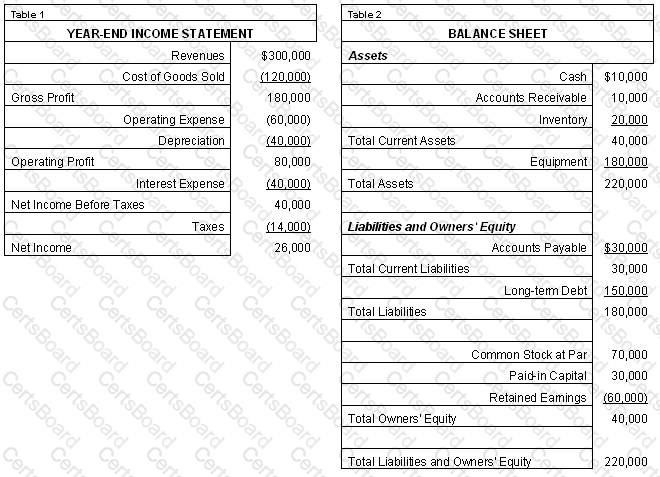

The year-end income statement for a company is presented in Table 1. The balance sheet is presented in Table 2.

What is the company's return on equity?

A North American service company has autonomous offices in different geographic regions each handling their own sales and accounts receivables deposits to local banks which primarily consist of checks. By implementing a lockbox collection system, what objective in its collection policy would it have met?

The yield curve is inverted. A creditworthy firm considering alternative debt maturities would MOST LIKELY:

What must be measured and monitored to ensure that a company has adequate liquidity?

An instrument that gives the right to buy a stated number of shares of common stock at a specified price is known as:

A company’s capital structure includes $800,000,000 in total capital, of which $200,000,000 comes from debt. The firm’s after-tax cost of debt is 6%, and its cost of equity is 12%. The marginal tax rate is currently 40%. What is the company’s weighted average cost of capital?