ABL Corporation is currently receiving a return of 10% on its investments. The bank is offering them an ECR of 15%. In order to get more value for their money ABL Corp. has decided to take advantage of the higher ECR and use funds from its Money Market Accounts to cover bank service charges.

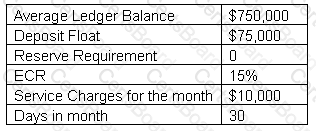

If ABL already has an average ledger balance of $750,000, how much more do they need to deposit on their account to cover all $10,000 of monthly service charges?

A company transfers funds from its remote accounts by ACH with a one-day settlement and is notified of a same-day credit of $100,000 in one of its accounts. A wire transfer costs $27.75 incrementally. Assuming a 360-day year, which of the following is the minimum rate of interest that must be earned on these funds to justify the cost of a wire transfer?

To arrive at the closing cash position, a cash manager must add the expected settlements in the collection and concentration accounts and deduct the projected disbursement totals from the:

An airline has entered into an agreement with its partners to offset receivables and payables for a specified period of time and to transmit or receive the difference via funds transfer at the end of the period. This is an example of:

The cash manager for a company is creating a list of transactions that should be considered when determining the daily projected closing cash position. Which of the following transactions should be removed from the list?

If a company does not have cash available to make an interest payment on a bond, the company is experiencing difficulty with its:

If the spot foreign exchange rate and the forward foreign exchange rate are the same between two countries, which of the following is implied?