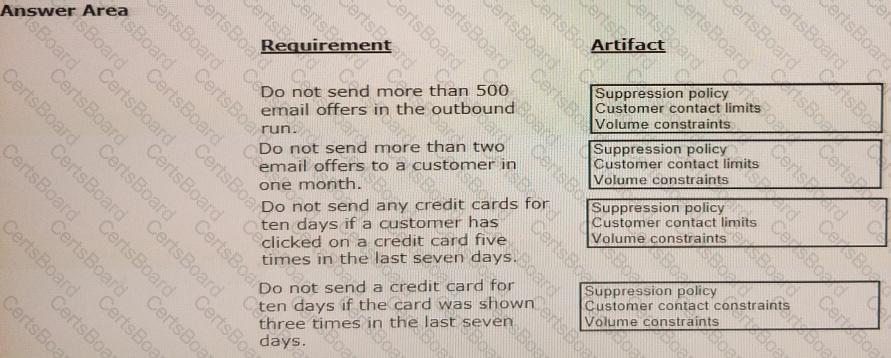

U+ Bank's marketing department currently promotes various credit card offers by sending emails to qualified customers. The bank wants to limit the number of offers that customers can receive over a given period of time.

In the Answer Area, select the correct artifact you use to implement each requirement.

A bank has been running traditional marketing campaigns for many years. One such campaign sends an offer email to qualified customers on day one. On day five, the bank presents a similar offer if the first email is ignored.

If you re-implement this requirement by using the always-on outbound customer engagement paradigm, how do you approach this scenario?

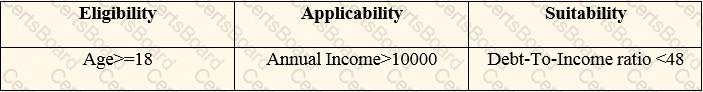

U+ Bank, a retail bank, is currently presenting a cashback offer on its website. Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer.

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45 As business user, what are the two tasks that you define to update the cashback offer? (Chose Two)

U+ Bank uses Pega Customer Decision Hub™ to display an offer to its customers on the U+ Bank website.

The bank wants to ensure that Silver credit cards are not offered to customers under 27 years of age. They also want to ensure that Platinum cards are offered only to customers who had a positive balance in the last year.

What do you configure in the Next-Best-Action Designer to achieve this outcome?

Reference module: Creating and understanding decision strategies. In a Prioritize component, the top action can be determined based on the value of _______.

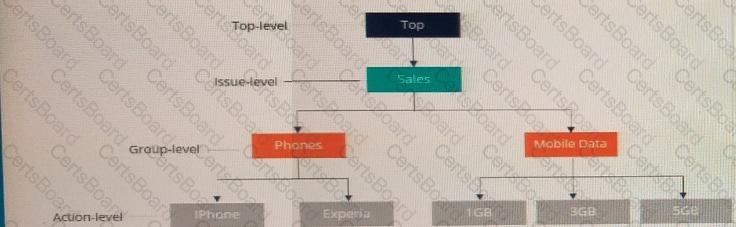

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what must you do to present offers from the two groups?

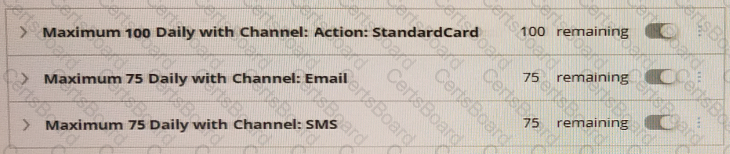

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel.

If the following volume constraint is applied, how many actions are delivered by the outbound run?

A bank wants to automatically pause actions that are shown too often for a specific time period. Which rules do you need to define?

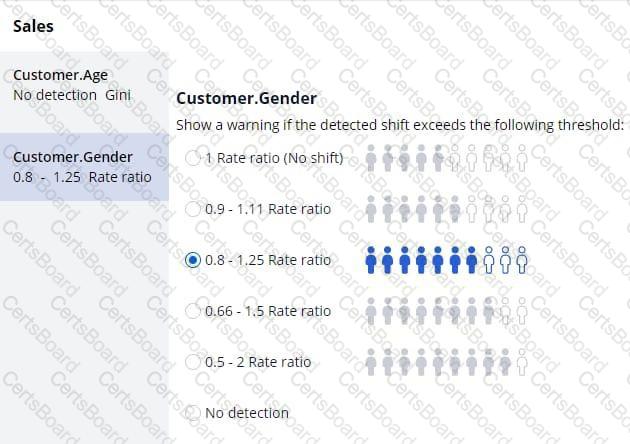

Reference module: Detecting unwanted bias

MyCo, a telco, has introduced mobile data packages for students. As a policy, MyCo does not want to discriminate based on gender when presenting the offers. As a Decisioning Consultant, how do you configure the ethical bias policy to allow no bias?

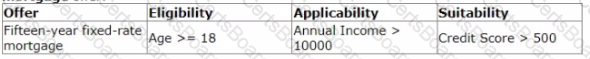

U+ Bank, a retail bank, has recently implemented a project in which qualified customers see mortgage offers when they log in to the web self-service portal.

Currently, only the customers who satisfy the following engagement policy conditions receive the Fifteen-year fixed-rate mortgage offer:

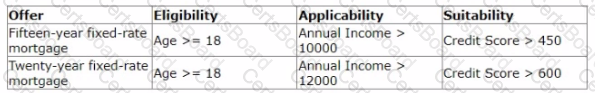

The bank decides to make two changes:

1. Update the suitability condition for the Fifteen-year fixed-rate mortgage offer.

2. Introduce a new offer, Twenty year fixed-rate mortgage.

The following table shows the new engagement policy conditions for both mortgage offers:

What is the best practice to fulfill this change management requirement in the Business Operations Environment?