Using Pega Customer Decision Hub, a mobile company transitions from a one-to-many to a one-to-one marketing approach.

The company is introducing a new data plan.

To offer the new data plan, what must the mobile company focus on when implementing the Next-Best-Action paradigm?

A bank is currently displaying a group of mortgage offers to its customers on their website. The bank wants to suppress the mortgage group for 1 month if a customer ignores three mortgage offers within that group. How do you define the suppression rule for this requirement?

MyCo, a telecommunications company, wants to present customers with a free 2GB data offer when contacting the call center for mobile number portability. Which arbitration factor do you configure to implement this requirement?

U+ Bank has recently implemented a cross-sell on the web microjourney and is satisfied with the results. The bank now wants these Next-Best-Action recommendations to be delivered via outbound communication channels. Select two outbound channels that U+ bank can use to deliver Next-Best-Action recommendations. (Choose Two).

A bank developed a scorecard to automate the loan approval process. In the scorecard rule, there is a classification implemented using three score bands: Not Approved, Refer to Manager, and Approved. Which property allows you to use the result of this classification in a decision strategy?

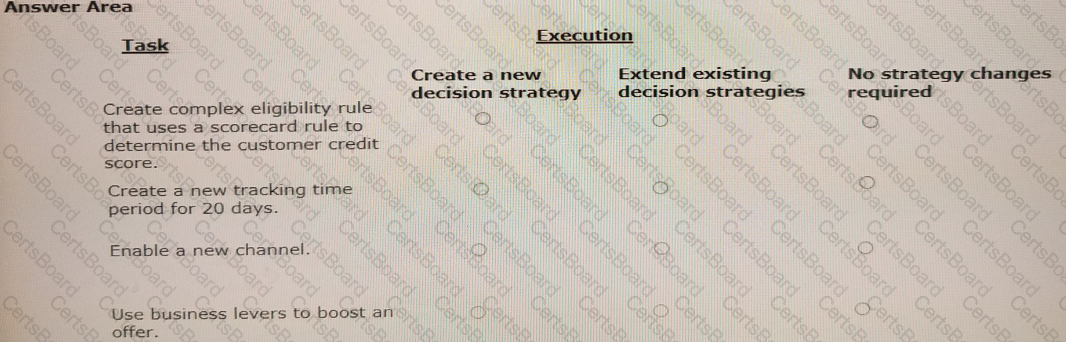

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hub™. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

Myco, a telecom company, has recently implemented Pega Customer Decision Hub™. Now, the company wants to move away from traditional marketing and leverage the always-on outbound capabilities.

What artifact do you configure to translate the traditional segments used to identify the target audience?

Next-Best-Action ensures that communication between the business and the customer is__________ and __________ (Choose Two)

MyCo, a telecommunications company, wants to implement one-to-one customer engagement using Pega Customer Decision Hub™. Which of the following real-time channels can the company use to present Next-Best-Actions? (Choose Three)

U+ Bank has launched a new credit card for all customers with a premium bank account. As a decisioning consultant, you need to create actions that involve the full customer life cycle: marketing, sales, and service.

Which two valid actions do you create? (Choose Two)