The following question requires your selection of Scenario 1.4.150 from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Annual depreciation (in USS) would be calculated as follows for a capital recovery with salvage analysis:

The following question requires your selection of CCC/CCE Scenario 2 (2.3.50.1.2) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

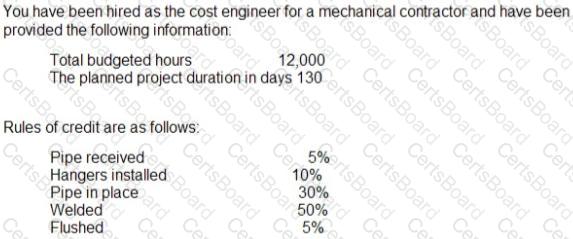

10,278 hours have been expended to date. The CPI at this point in time is 0.93. SPI is 1.03. How many hours have been earned?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

You have been asked to provide ETC information to management. Based on the following information, what is the ETC?

Original Budget = $9,000,000

Actuals to date = $3,513,000

Current estimate at completion = $10,613,000

Actuals for current month = $1,200,000

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Assuming the average life span of a lithium battery is two years and is normally distributed with a standard deviation of two months, what is the probability the battery will last between 20 months and 26 months?

Productivity increases with time. This improvement is commonly associated with improvements in efficiency brought about by increased experience and skill levels. What does this scenario describe?

Which of the following are used for profitability analysis in a construction company?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

What is the 25 year after tax present worth of this project?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of thedesign contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

Which of the following percent complete measurement techniques is best suited for long-term non-production accounts (such as overhead accounts)?

The discount rate is a measure used to convert cash flow streams occurring to different points in time to a common base called the net present worth. What is the discount rate based upon?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

How much money should be set aside today to have $20,000 available eight (8) years from now if the interest rate is 6% compounded annually?