An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If you buy a lot for $3,000 and sell it for $6,000 at the end of 8 years, what is your annual rate of return?

Money is value. Having money when you need it is very important. Money can also be valuable when used wisely by knowing when to spend and when to conserve Also, planning now for future expenses can be a plus to the company rather than a debit.

There are several ways to capitalize money and spending. Basically there is the single payment method that has a compound amount factor and a present worth factor. There is the uniform annual series that has a sinking fund factor, capital recovery factor and also the compound amount factor and present worth factor. At this point, we can assure money is worth 10%.

The following question requires your selection of CCC/CCE Scenario 7 (4.8.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

If you are scheduled for a $100,000 payment at the end of each year for the next five years, what is the equivalent amount if you were to make a lump sum payment now?

Which of the following is a disadvantage to using target contract as a method of contracting?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

If $50 was invested at 6.0% on January 1, year 1, what would be the value of year-end withdrawals made in equal amounts each year for 10 years and leaving nothing in the fund after the tenth withdrawal?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Which of the following calculations would not be needed to determine "net income?'

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following would NOT be considered part of a project cost and schedule forecast?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

Which of the following interest rates disregards the effects of compounding periods that occur more frequent than annually?

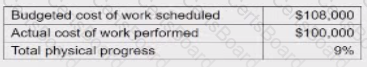

A small hole construction project has a baseline budget of $1,000,000. The project is scheduled to be constructed in 12 months. At the and of the first month, the project data is reported as below:

The following question requires your selection of Scenario 1.4.162 from the right side of your split screen, using the drop down menu, to reference during your response/choice of response.

The budgeted cost work performed is;

When a person hears the words being said to him/her, but does not receive the message of the words, it is called

What do you call a person authorized to represent another (the principal) in some capacity? He/she can only act within this capacity or "scope of authority" to bind the principal.