If you deposit $100 per month for two (2) years and earn interest at 12% APR (Annual Percentage Rate) compounded monthly, how much will you have at the end of the period?

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

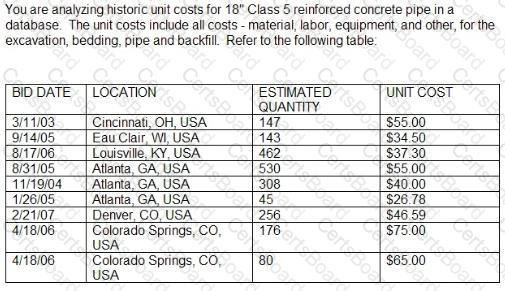

What is the range of estimated quantities?

The following question requires your selection of CCC/CCE Scenario 6 (2.7.50.1.3) from the right side of your split screen., using the drop down menu, to reference during your response/choice of responses.

What is the range of unit costs?

When using a fixed-price./lump-sum contract, which of the following; situations can a payment be made for the adjustment of fluctuations in the cost of of construction resources?

An agricultural corporation that paid 53% in income tax wanted to build a grain elevator designed to last twenty-five (25) years at a cost of $80,000 with no salvage value. Annual income generated would be $22,500 and annual expenditures were to be $12,000.

Answer the question using a straight line depreciation and a 10% interest rate.

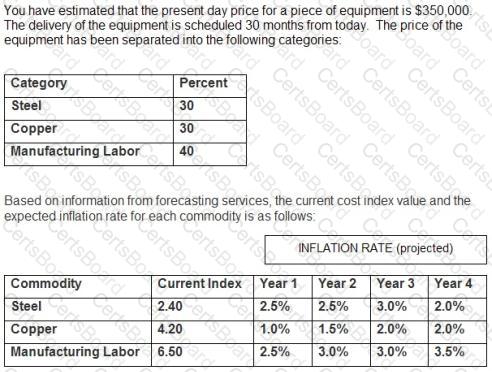

The following question requires your selection of CCC/CCE Scenario 17 (4.2.50.1.1) from the right side of your split screen, using the drop down menu, to reference during your response/choice of responses.

Assuming a 53% tax rate, how much cumulative depreciation will have been claimed at the end of the grain elevator's life span?

You have recently been appointed as the Cost Engineer to oversee process improvement projects for a Discrete Part Manufacturer. You have been asked to calculate the CPI on a project initiated to implement a Value Stream Mapping Initiative. The accountant is only able to provide you with BAC and EAC figures of $ 5000 and 57500 respectively. The CPI is:

unable to be calculated from the information given

What relationship more accurately defines a situation model of parallel activities that require a partial start of one activity?

A used concrete pumping truck can be purchased for $125,000. The operation costs are expected to be $65,000 the first year and increase 5% each year thereafter. As a result of the purchase, the company will see an increase in income of $100,000 the first year and 5% more each subsequent year. The company uses straight-line depreciation. The truck will have a useful life of five (5) years and no salvage value. Management would like to see a 10% return on any investment. The company's tax rate is 28%.

Which of the following statements is correct?

A major theme park is expanding the existing facility over a five-year period. The design phase will be completed one year after the contract is awarded. Major engineering drawings will be finalized two years after the design contract is awarded and construction will begin three years after the award of the design contract. New, unique ride technology will be used and an estimate will need to be developed to identify these costs that have no historical data.

In Rensis1 4 model system, the exploitative-authoritative management style is one in which: