A corn farmer has committed to sell 20,000 bushels of corn in November. The spot price has a standard deviation of 20 cents per bushel, and its correlation with the December futures prices is 0.9. The futures contract is for 5000 bushels and has a standard deviation of 24 cents per bushel. What should the corn producer do if he/she wishes to hedge the risk of price movements between now and November?

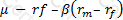

Which of the following expressions represents the Treynor ratio, where μ is the expected return, σ is the standard deviation of returns, rm is the return of the market portfolio and rf is the risk free rate:

A)

B)

C)

D)

A bank holds a portfolio of residential mortgages. An increase in the volatility of mortgage interest rates leads to:

Which of the following statements are true:

I. For a delta neutral portfolio, gamma and theta carry opposite signs

II. The sum of the absolute value of gamma for a call and a put for the same option is 1

III. A large positive gamma is desirable in a delta neutral portfolio

IV. A trader needs at least two separate tradeable options to simultaneously make a portfolio both gamma and vega neutral

The price of a bond will approach its par as it approaches maturity. This is called:

[According to the PRMIA study guide for Exam 1, Simple Exotics and Convertible Bonds have been excluded from the syllabus. You may choose to ignore this question. It appears here solely because the Handbook continues to have these chapters.]

The use of numerical pricing methods over analytical methods for valuing exotic options is resorted to allow for which of the following reasons:

I. Efficient valuation

II. Allowing for stochastic volatility

III. Accommodating discontinuous asset prices

IV. Allowing for complex payoffs

What kind of a risk attitude does a utility function with downward sloping curvature indicate?

For a pair of correlated assets, the achievable portfolio standard deviation will be the lowest when the correlation ρ is:

Which of the following reflects the pricing convention for currency forwards, where one of the currencies is USD?