An employee has YTD wages in the amount of $250,000.00 and receives a $1,753.00 bonus payment. Using the optional flat rate method, calculate the federal income tax withholding from the bonus payment.

Even if a worker meets the definition of an employee, an employer can still treat the worker as an independent contractor if the worker passes the:

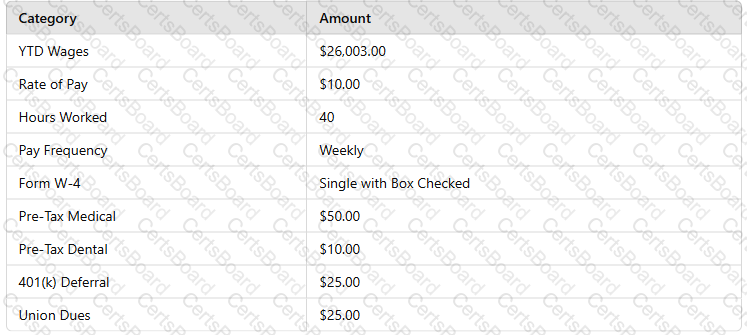

Using the wage bracket method and the information below, calculate the employee's weekly net pay.

All of the following objectives are included in the operations of a Payroll DepartmentEXCEPT:

Which of the following master file components is NOT part of the employment data?

All of the following criteria are used to determine FMLA eligibility EXCEPT the number of:

All of the following statements are correct regarding independent contractors EXCEPT that they: