An employee has $240,000.00 in YTD taxable wages and receives a taxable fringe benefit of $2,500.00. Calculate the Medicare and FITW using the optional flat rate method for the taxable fringe benefit.

Documentation on legislative changes to Forms W-2 and W-3 is initiated by which of the following organizations?

A semiweekly depositor accumulates a payroll tax liability of $49,000.00 on Thursday. The next day, the company has bonus payroll with a tax liability of $120,200.00. Calculate the amount of tax deposit and its due date.

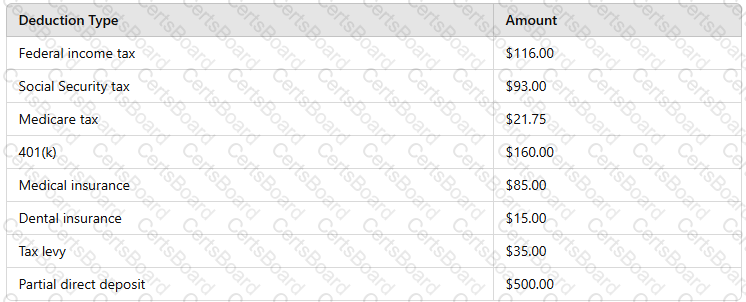

An employee receives $1,600.00 biweekly from their employer. Using the following information, calculate the total amount of voluntary deductions.

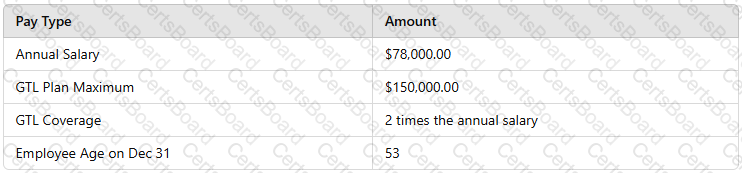

Using the following information, calculate the imputed income that MUST be included in the employee’s monthly gross pay.

The lowest priority is given to which of the following time management categories?