Which of the following is a true statement about operating leverage?

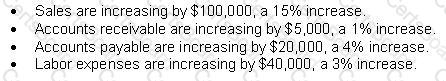

A company is experiencing the following long-term trend on a month-over-month basis:

With all other income, expenses, long-term assets and liabilities remaining stable, this trend would MOST LIKELY prompt what action by the company?

Company XYZ is conservative when investing in their short-term portfolio. XYZ is looking to add the following money market instruments in their own country: a reverse re-purchase agreement, a floating-rate note, and a negotiable certificate of deposit. What types of investment risks are associated with these instruments?

A company is looking to improve its collection rate of returned checks. If the company implements re-presented check entry (RCK) with its bank, it might see a reduction in what type of returned items?