Investors typically require a higher yield as compensation for holding securities that have:

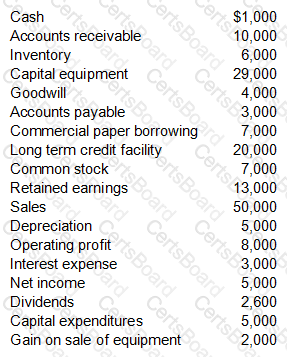

BF Company, a manufacturer of food products, reported financial information shown in the table below for the end of the year.

BF Company is subject to covenants under its revolving credit facility. It is in compliance with which of the following?

A financially sound company sends wires to investors in the morning but does not receive replacement funds until the afternoon. Which facility will the company MOST LIKELY arrange with its bank to facilitate the company’s wire payment activities on any given day?

Company M operates a grocery distribution business on Main Street. As part of its business continuity plan, Company M intends to purchase insurance to cover the facility lease for its Main Street warehouse in the event it cannot operate for a period of time. What type of coverage should Company M purchase?