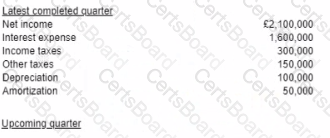

LMN Ltd, a British firm, has a financial covenant with its bank mat interest coverage based on earnings before interest taxes, depreciation, and amortization (EBITDA), must be at least 2.5 for each quarter Shown below are summary financial data.

An expected decline m sales will result In net Income of £ 1.500.000 The other elements of EBITDA will be similar to the most recently completed Quarter Given the above information, what is the ratio for the latest completed quarter and do the forecasted results meet the required covenant?

Which one of the following situations describes a secondary offering of stock by a company?

Studler’s Restaurant is considering a contract to supply the weal senior citizen center with 10,000 meals. Regular sales at regular prices would be unaffected. The food cost for each meal s S3 Additional costs incurred as a result of the contract would De variable overhead of S 50 and variable selling general and administrative costs of S SO per meal sold. The selling price per meal would be $5, A total of $20,000 in fixed costs would be allocated at $2 per meal. The fixed costs are part of an overall total of $500,000 in annual fixed costs incurred regardless of the contract. What will be the effect on pretax income if Studiers takes the special order?