Last Update Mar 31, 2025

Total Questions : 124

Last Update Mar 31, 2025

Total Questions : 124

CMA Part 2: Strategic Financial Management Exam

Last Update Mar 31, 2025

Total Questions : 124

Why Choose CertsBoard

Customers Passed

IMA CMA-Strategic-Financial-Management

Average Score In Real

Exam At Testing Centre

Questions came word by

word from this dump

Try a free demo of our IMA CMA-Strategic-Financial-Management PDF and practice exam software before the purchase to get a closer look at practice questions and answers.

We provide up to 3 months of free after-purchase updates so that you get IMA CMA-Strategic-Financial-Management practice questions of today and not yesterday.

We have a long list of satisfied customers from multiple countries. Our IMA CMA-Strategic-Financial-Management practice questions will certainly assist you to get passing marks on the first attempt.

CertsBoard offers IMA CMA-Strategic-Financial-Management PDF questions, web-based and desktop practice tests that are consistently updated.

CertsBoard has a support team to answer your queries 24/7. Contact us if you face login issues, payment and download issues. We will entertain you as soon as possible.

Thousands of customers passed the IMA Designing IMA Azure Infrastructure Solutions exam by using our product. We ensure that upon using our exam products, you are satisfied.

According to the IMA Statement of Ethical Professional Practice, identify and explain the standard(s) that Matthew would violate if he chooses not to report the issue regarding the accounting manager.

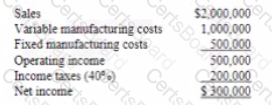

Apex Manufacturing lnc. (AMI) is a Canada-based company that manufactures a manufactures and unique part for aircrafts. It has few competitors in the market. The company is exposed to exchange rate risk because about 90% of its products are exported to the U.S, and most of its sales contracts are in U.S. dollars. AMI has the capacity to manufacture 1,500 units of the part per year. For the year just ended. AMI manufactured and sold 1,000 units. The operating results are shown below.

Recently, A new customer made a one-area order of 500 units of the part at $1.200 per unit. The CTO asked the controller to analyze this offer. AMI is considering adjusting its sales price next year in a recent meeting, the CFO suggested to use the market-based approach for pricing decisions, bat the controller insisted that the cost-based approach is more favorable to the company.

Define the term structure of interest rates and explain now it could impact QDD's objective of obtaining the lowest coupon rate

Essay

Quality Digital Design (QDD) Inc is a public-traded technology company Selected financial data of QDD for the prior year are as follows

QDD's stock was trading at $160 per share at the beginning of the yea: and at $176 per share by the end of the year. The company paid dividends of S5 per share. The company "s stock had a beta of 1 4 The stock market provided a total return of 12% last year, well above the 3°o risk free rate of return

QDD is considering the issuance of $200 million of bonds to fund the repurchase of $200 million of its stock. QDD is evaluating the bond, including its term structure, maturity, and whether it should be callable obtaining the lowest coupon interest is an important objective of QDD. The CFO has estimated that sales for the current year would remain the same as last year and the new bond would add S12 million in annual interest payments

Explain me concept of relevant cost in the season-making process and discuss whatever the €200, 000 course development coil is relevant to OLi's price decisions in future years

Essay

Online Learning Inc. lOLI) is a privately-held company based in the IUC that specializes in providing online courses in English as a Second Language (ESL). OLI is trying to set up a new sales office in a foreign country. It needs a business license to operate in that country. The license normally lakes six months to obtain. An official of that country said that he could expedite the process for a fee of €300.

OLI estimates the new sales office can bring €300,000 incremental profit annually OLI has just launched a new online 40-houi course to help adult ESL learners master basic business English. The price of the new course is €500 per student, the variable cost is €300 per student, and the total fixed cost of the new course is €300.000 per year OLI spent €200.000 to develop the new course before launching it. There are many online course providers in the marketplace, and each has its own feature However, OLI's highly qualified staff and good reputation have enabled it to charge a premium price compared to its major competitors. Recent market research indicates that if OLI raises the price of its new business English course by 10V the student enrollment would decrease by 5V A regional airlines company in Asia has approached OLI and offered to enroll 1.000 of its employees in the new course if OLI would agree to a special price of €350 per employee If OLI accepts this offer, an additional €10,000 onetime cost would be required to temporally expand its capacity to accommodate the new students.