Studler’s Restaurant is considering a contract to supply the weal senior citizen center with 10,000 meals. Regular sales at regular prices would be unaffected. The food cost for each meal s S3 Additional costs incurred as a result of the contract would De variable overhead of S 50 and variable selling general and administrative costs of S SO per meal sold. The selling price per meal would be $5, A total of $20,000 in fixed costs would be allocated at $2 per meal. The fixed costs are part of an overall total of $500,000 in annual fixed costs incurred regardless of the contract. What will be the effect on pretax income if Studiers takes the special order?

Which one of the following situations describes a secondary offering of stock by a company?

LMN Ltd, a British firm, has a financial covenant with its bank mat interest coverage based on earnings before interest taxes, depreciation, and amortization (EBITDA), must be at least 2.5 for each quarter Shown below are summary financial data.

An expected decline m sales will result In net Income of £ 1.500.000 The other elements of EBITDA will be similar to the most recently completed Quarter Given the above information, what is the ratio for the latest completed quarter and do the forecasted results meet the required covenant?

A management accountant overheard the company's procurement manager discussing a kickback payment for one of the company s recent projects. The procurement manager promised to pay a share to the other person II the arrangement was kept confidential According to the IMA Statement of Ethical Professional Practice which one of the following is the most appropriate action for the management accountant to take?

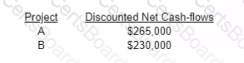

Southwest Supplies Inc. (SSI) is considering the following two projects with cash-flows discounted at SSI's weighted average cost of capital.

SSI can only afford to invest in one of the projects. Which statement would most likely explain why SSI would choose Project B over project A?

A capital budgeting analysis involves an initial investment of $500. The expected cash inflow in Year 1 is $300, and the expected cash inflow in Year 2 is $350. Which one of the following equations can get the correct internal rate of return (IRR) of this project?

Management is responsible for identifying potential events mat could represent opportunities or threats. Which one of the following is not a viable event identification technique?

Genco Healthcare has asked ns controller to summarize the company’s financial performance for the past two years. The accountant provided the following two years financial ratios for reference.

Discuss whether AMI should use a cost-based or a market-based pricing approach. Explain your answer.

Essay

Food Depot Ltd, (FDL) is a privately-held company that provides catering services to airlines and operates several restaurant chains including fast food, casual dining, and fine dining restaurants, FDL has been profitable in recent years and has a very strong cash position. FDL's newest division. Food_TO-Go is an online meal ordering and delivery platform acquired by FDL two year ago.

In 20X7, sales for the entire company were $1 billion, with 50% of the business coming from the Airline Catering division. FDL is the country ‘s leading airline catering services provider and control 60% of the market share. However, the outlook of the airline catering industry is gloomy. The compound annual growth rate of the industry for the past five years was only 0.5% as airline networks have increasingly dropped catering on short domestic flights.

The Food-To-division only contribution 5% of FDL’s total sales in 20X7 and is far behind in competing for marketing for market share of the online meal ordering and delivery industry, it is estimated that Food-To-Go’s sales were only 20% of the industry leader’s sales. However, the outlook for the online meal ordering and delivery services industry is bright. The compound annual growth rate of the industry since it started three years ago was 50%. It is estimated the rapid growth of the industry will continue in the foreseeable future.

Susan Willey, the head of Food-To-Go, does not agree that the Airline Catering division is the best-performing division in the company. Wiley argues that ber division bad the highest ROI in 20X7, and it deserves more capital finding. FDL’s requested rate of return is 12%. The selected financial data for the Airline Catering division and Food-To-Go division in 20X7 are as follow (in $ millions)