Myco, a telecom company, has recently implemented Pega Customer Decision Hub™. Now, the company wants to move away from traditional marketing and leverage the always-on outbound capabilities.

What artifact do you configure to translate the traditional segments used to identify the target audience?

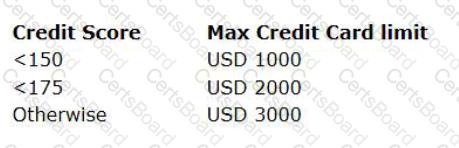

U+ Bank uses a Next-Best-Action decision strategy to automatically approve credit card limit changes requested by customers. A scorecard model determines the customer credit score. The automatic approval of credit card limits are processed based on the following criteria set by the bank:

The bank wants to change the threshold value for the USD 2000 credit limit from “<175” to “<200”.

As a Strategy Designer, how do you implement this change?

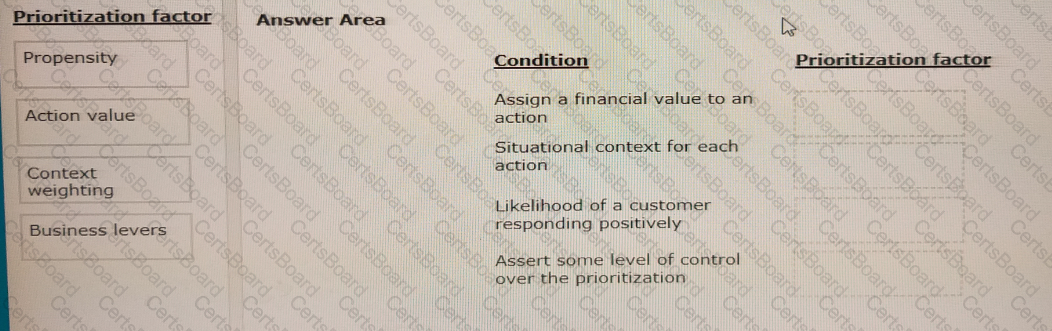

You are a decisioning consultant responsible for configuring offer prioritization for home loan offers based on the business requirements.

Select each prioritization factor on the left and drag it to the correct condition on the right.

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

MyCo, a mobile company, uses Pega Customer Decision Hub™ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning consultant, what must you do to present offers from the two groups?

MyCo, a telecom company, wants to send promotional emails to give away phone accessories. The accessories can only be given away in batches of 50. When the stock in a batch is completed, a new batch can be promoted again.

You have decided to use volume constraint to limit the number of actions in a batch. To meet the business requirement, what Reset Interval setting do you select?

U+ Bank wants to offer credit cards only to low-risk customers. The customers are divided into various risk segments from Good to Very Poor. The risk segmentation rules that the business provides use the Average Balance and the customer Credit Score.

As a decisioning consultant, you decide to use a decision table and a decision strategy to accomplish this requirement in Pega Customer Decision Hub™.

Using the decision table, which label is returned for a customer with a credit score of 240 and an average balance 35000?

U+ Bank has recently introduced a few mortgage offers that are presented to qualified customers on its website- The business now wants to prevent offer overexposure, as overexposure negatively impacts the customer experience.

Select the correct suppression rule for the requirement: If a customer has clicked on any of the mortgage offers a total of three times in the last 7 days, do not show any mortgage offers to that customer for the next 10 days.