MyCo, a telecom company, developed a new data plan group to suit the needs of its customers. The following table lists the three data plan actions and the criteria that customers must satisfy to qualify for the offer:

You are the decisioning architect on an Al-powered one-to-one customer engagement implementation project. You are asked to design the next-best-action prioritization expression that balances the customer needs with the business objectives.

What factor do you consider in the prioritization expression?

U+ Bank wants to use Pega Customer Decision Hub™ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

U+ Bank uses a scorecard rule in a decision strategy to compute the mortgage limit for a customer. U+ Bank updated their scorecard to include a new property in the calculation: customer income.

What changes do you need to make in the decision strategy for the updated scorecard to take effect?

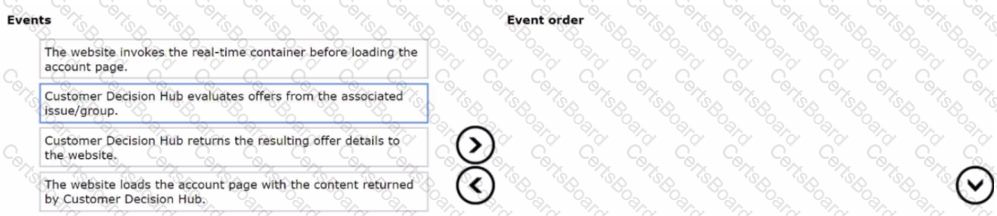

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hub™ on its website to promote new offers to each customer.

Place the events in the sequential order.

Pega Customer Decision Hub enables organizations to make Next-Best decisions. To which type of a decision is Next-Best-Action applied?

U+ Bank has recently defined two contact policies:

1. Suppress a group of credit card offers for 30 days if any credit card offer is rejected three times in any channel in the past 15 days.

2. Suppress the Reward card offer, part of the credit card group, for 7 days if it is rejected twice in any channel in the last 7 days. Paul, an existing U+ Bank customer, no longer sees the Reward card offer. What is the reason that Paul cannot see the offer?

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer. What is the next step that Pega Customer Decision Hub takes?

U+ Bank wants to use Pega Customer Decision Hub™ to display a credit card offer, the Standard Card, to every customer who logs in to the bank website. What three of the following artifacts are mandatory to implement this requirement7 (Choose Three)

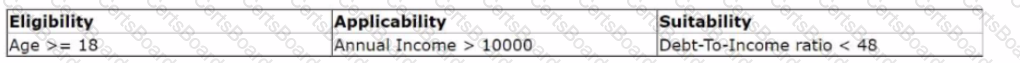

U+ Bank, a retail bank, is currently presenting a cashback offer on its website.

Currently, only the customers who satisfy the following engagement policy conditions receive the cashback offer:

While continuing cross-selling on the web, the bank now wants to present the cashback offer through a new channel, SMS. The bank also wants to update the suitability condition by lowering the threshold of the debt-to-income ratio from 48 to 45.

As a business user, what are the two tasks that you define to update the cashback offer? (Choose Two)