A company is determining the selling price for its new product.

At a selling price of $16 per unit there will be zero demand but for every $1 reduction in the price, demand will increase by 100 units per period.

Production must be in batches of 100 units. The variable cost per unit will be $8 if 400 units are produced in a period. For each additional batch produced in a period the variable cost per unit will increase by $1 per unit for the additional batch only.

No inventories will be held.

Which of the following sales and production volumes will generate the highest contribution per period?

In order to remain competitive an organization wishes to achieve cost savings for one of its existing products.

Which of the following correctly describes methods which the organization can use to achieve these cost savings?

Select ALL that apply.

A company is considering investing $150,000 in a project which will generate the following contributions during the first three years.

Tax depreciation allowance is 25% each year of the reducing balance.

The taxation rate is 30% of taxable profits and tax is payable in the year after that in which it arises.

To the nearest $10, what is the forecast total project cash flow in year 3?

Division A is an investment centre with assets of $7.3 million. The following is an extract from the annual budget for division A:

The cost of capital is 14%.

Calculate the residual income for division A.

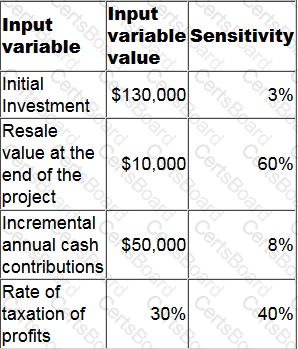

A project is viable because it has a positive net present value (NPV).

Details of four of the input variables, together with the sensitivity of the viability of the project to a change in each one in isolation, are given below.

Which of the following statements is correct?

Which of the following is the ideal basis to use for a transfer price when there is a perfect external market?

A supermarket group has experienced operational problems during recent years, including a shortage of warehousing space due to increasing turnover and poor inventory management. The product portfolio has expanded considerably. Although this has led to increased sales volume, marketing and logistics costs have increased disproportionately. Non product-specific costs have also increased significantly.

Management is now considering using Direct Product Profitability (DPP).

Which of the following statements are valid in respect of the possible implementation of DPP within the supermarket group?

Select ALL that apply.

Place each performance measure against the correct perspective of the Balanced Scorecard for a company that operates a chain of hotels.

Place the correct quality cost classification against each cost described below.