A company makes and sells three products A, B and C. The products are sold in the ratio of A:B:C = 1:1:4.

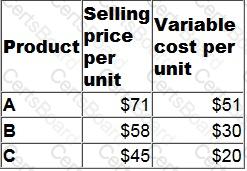

Monthly fixed costs are $150,000. Product details are shown below:

What sales value of product C is required to achieve a target profit of $72,000 next month?

Give your answer to the nearest whole $ (in '000s).

‘Public sector organizations are often judged by their economy, efficiency and effectiveness. Consequently, they should use an approach to budgeting other than incremental budgeting.’

Required:

Explain ONE advantage and TWO disadvantages of public sector organizations using incremental budgeting.

Select all true statements.

The manager of a recently opened cafe is deciding how many sandwiches to make each day.

The sandwiches are made in the morning before the cafe opens.

If demand exceeds the number of sandwiches made in the morning no extra sandwiches can be made during the day. Any unsold sandwiches are thrown away at the end of each day.

Daily demand is uncertain but is predicted to be 10, 20, 30 or 40 sandwiches.

The following regret matrix has been prepared:

If the minimax regret criterion is used to make the decision, the manager will choose to make:

A medium-sized manufacturing company, which operates in the electronics industry, has employed a firm of consultants to carry out a review of the company’s planning and control systems. The company presently uses a traditional incremental budgeting system and the inventory management system is based on economic order quantities (EOQ) and reorder levels. The company’s normal production patterns have changed significantly over the previous few years as a result of increasing demand for customized products. This has resulted in shorter production runs and difficulties with production and resource planning. The consultants have recommended the implementation of activity based budgeting and a manufacturing resource planning system to improve planning and resource management.

What are the benefits for the company that could occur following the introduction of an activity based budgeting system?

Select ALL the correct answers.

A major company sells a range of electrical, clothing and homeware products through a chain of department stores. The main administration functions are provided from the company’s head office. Each department store has its own warehouse which receives goods that are delivered from a central distribution center.

The company currently measures profitability by product group for each store using an absorption costing system. All overhead costs are charged to product groups based on sales revenue. Overhead costs account for approximately one-third of total costs and the directors are concerned about the arbitrary nature of the current method used to charge these costs to product groups.

A consultant has been appointed to analyses the activities that are undertaken in the department stores and to establish an activity based costing system.

The consultant has identified the following data for the latest period for each of the product groups for the X Town store:

Calculate the total profit for each of the product groups:

…. using the current absorption costing system;

A company manufactures a machine. The machine is made from two types of raw material and is assembled in a factory using skilled labour. The engine for the machine is purchased from an outside supplier.

The following costs relate to the manufacture of one machine:

What is the finished goods inventory valuation for one machine using throughput costing?

The cost card for one unit of Product G is as follows:

The opening and closing inventories of Product G for month 5 are budgeted to be 10 units and 60 units respectively.

Profit for month 5 using absorption costing is budgeted to be $15,000.

What is the budgeted profit for month 5 using throughput costing?

Explain why sensitivity analysis is useful when dealing with uncertainty in project

appraisal.

Select all the true statements.

The standard production cost of making a product is as follows:

What is the fixed production overhead capacity variance?

Traditional absorption costing is more suitable than activity-based costing when: