Company X is a private limited oil company. Which of the following are relevant for Company X's integrated report?

AB sold a machine for $15,000 The machine had originally cost $160,000 and al the dale of disposal had a carrying value of $26,000.

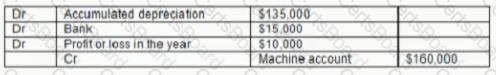

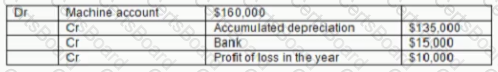

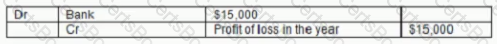

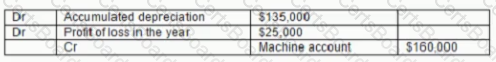

The journal entry lo record this disposal is:

A)

B)

C)

D)

The profit earned by Subramanian in 2006 was £ 50,000. He injected new capital of £12,000 during the year and withdrew goods for his private use that cost £4,000.

If net assets at the beginning of 2006 were £10,000, what were the closing net assets?

Which of the following entries would result in the trial balance not agreeing?

(a) An invoice for £200 for electricity has been omitted from the ledgers

(b) A payment received from a customer has been posted to the accounts twice

(c) An invoice for repairs and maintenance has been charged to the non-current asset account

(d) A payment made to suppliers had been recorded in the cash book but not recorded in the supplier's account