Section C (4 Mark)

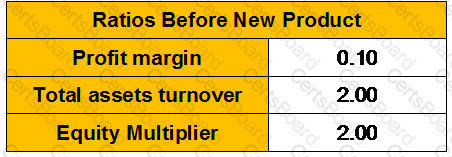

You are considering adding a new product to your firm's existing product line. It should cause a 15 percent increase in your profit margin (i.e., new PM = old PM x 1.15), but it will also require a 50 percent increase in total assets (i.e., new TA = old TA x 1.5). You expect to finance this asset growth entirely by debt. If the following ratios were computed before the change, what will be the new ROE if the new product is added and sales remain constant?

Section B (2 Mark)

In 2011-12, Steven has business profits of £34,125, net bank interest of £1,240 and net dividends of £9,000. He claims the personal allowance of £7,475. What is the income tax payable for the year after subtracting tax deducted at source?

Section B (2 Mark)

Consider these two investment strategies:

Strategy ___ is the dominant strategy because __________.

Section B (2 Mark)

Mr. A gifted debenture of Rs. 100000 to his wife. She received Rs. 10000 interest which she reinvests and earns Rs. 1000. This Rs. 1000 will be taxable in the hands of

Section B (2 Mark)

A Family consists of karta, his wife four sons and their wires and children and its income is Rs. 1000000 if by family arrangement income yield property is settled on karta his wife and sons & daughter in law than tax liability would be

Section A (1 Mark)

In hedge funds the risk of no standard platform for measurement and no standard format for reporting is called __________________

Section A (1 Mark)

____________ is defined as a dollar per thousand dollars of assessed value of property and is used to calculate a property owner's tax bill.

Section C (4 Mark)

An investor purchased on margin Alpha Computer for Rs. 30/- a share. The stock's price subsequently rose to Rs. 50/- a share at which time the investor sold the stock. If the margin requirement is 60 percent and the interest rate on borrowed funds was 7 percent, what would be the percentage earned on the investor's funds (excluding commissions)? What would have been the return if the investor had not bought the stock on margin?

Section B (2 Mark)

Under the Payment of Gratuity Act, 1972, where the employee employed in a seasonal establishment is deemed to be in continuous service for such period if he actually worked for not less than __________% of the number of days on which the such establishment was in operation during such period.

Section B (2 Mark)

Interest on UK government securities is exempt from UK income tax if the recipient is not ___ in the UK.

Section C (4 Mark)

Omax Inc. one of the largest developer of residential projects, reported earnings per share of Rs 8.0 in 2003, and paid dividends per share of Rs 4.8 in that year. The firm is expected to report earnings growth of 25% in 2004, after which the growth rate is expected to decline linearly over the following six years to 7% in 2009. The stock is expected to have a beta of 0.85 and current risk free rate is 6.25%.

Estimate the value of the firm using the H Model.

Section C (4 Mark)

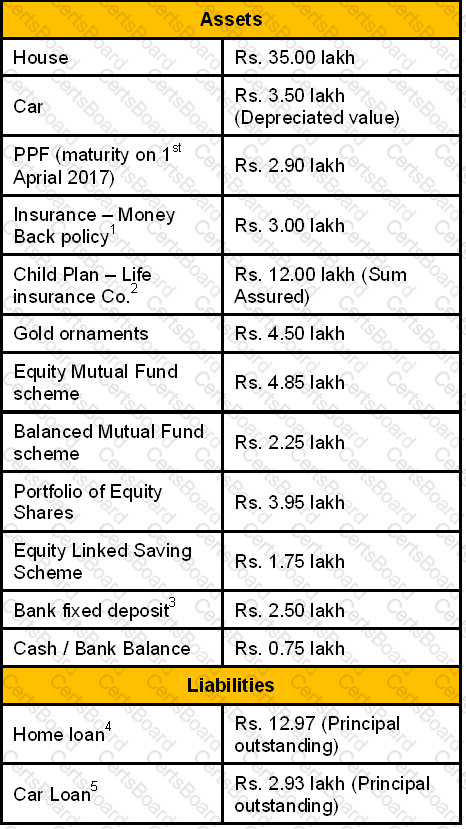

Sajan Mathews, aged 29 years (as on 2nd April, 2010), is working with a Multi National Company since December 2004. He has approached you, a CWM® for preparing his wealth plan. He is staying in his own house at Ahmedabad. His wife Jennifer, aged 31 years, is a fashion designer. She has earned a net profit of Rs. 4 lakh in FY 2008-09. They have a son, Mark of age 4 years (born on 12.02.2006), and a daughter, Stephanie (born on of 23.09.2009). Sajan is also supporting his parents staying in their own house at Surat to whom he sends Rs. 10,000 p.m. His monthly house hold expenses are Rs. 30000 p.m. (excludes his investments, payment of premia and EMIs). Sajan normally gets 5% increase in his gross salary year-on-year in the beginning of every financial year, apart from bonus. The effect for this year is yet to take place, though he has received a bonus of Rs. 3,31,680 for the year 2009-10. He has taken a family floater policy for health insurance involving an annual premium of Rs. 16268 and a total cover of Rs. 15 lakh.

Current Assets & Liabilities of the Family (As on 31st March, 2010 unless otherwise specified in foot notes)

____________

1.Purchased on 25th October, 2006, annual premium paid Rs. 14,798

2.Purchased on Mark’s 2nd birthday for a term of 15 years; annual premium Rs. 41,374

3.Subscribed on 01.09.2008 @ 10% p.a., with interest credited quarterly to his savings account; renewed at same rate for one year on 01.09.2009 without penal provision for premature withdrawal

4.Home loan of Rs. 17 lakh taken on 1st November, 2004 at a fixed interest of 7.5% p.a. for a 15 year term.

5.Car loan of Rs. 4.50 lakh taken on 1st April, 2008 at a fixed interest of 11.25% p.a. for a 4-year term.

Goals:

1.To provide for higher education of Mark and Stephanie. Initial expenses at their respective age of 18 years, Rs. 3 lakh (current cost), and subsequently Rs. 2 lakh p.a. for the next two years, and Rs. 3.5 lakh p.a. for the following 2 years.

2.Marriage expenses of Rs. 15 lakh (current cost) for each child at their respective age of 27 years.

3.Retirement corpus at the age of 58 years to sustain 70% of pre-retirement household expenses till his lifetime and 50% till stephanie’s expected life.

4.A Bigger house valued at Rs. 50 lakh today, a year from now.

5.To build a separate fund for vacation expenses of Rs. 2 lakh (at current cost) every year 10 years from now so that the corpus so built is self-sustaining till the marriage of Stephanie.

Assumptions: