M Ltd owns property costing $80,000 ($50,000 for the land and $30,000 for the building).

The company's accounting policy is to depreciate buildings at the rate of 5% per annum on the straight-line basis.

After five years, what is the net book value of freehold land and building in the financial accounts of M Ltd?

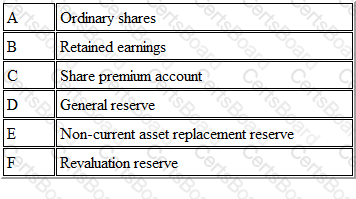

Refer to the exhibit.

Which three of the following would be classified as a revenue reserve?

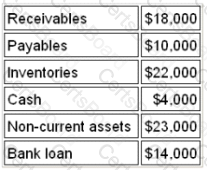

Refer to the Exhibit.

Your firm has the following manufacturing figures:

Closing work in progress is

Refer to the Exhibit.

You have been asked to prepare the sales ledger control account for the month of May, using the following information:

According to the accounts the opening receivables balance was £ 66,250

What is the closing receivables balance as at the end of May?

Refer to the Exhibit.

At the beginning of the year, the balance on the allowances for receivables account was £5000, representing 2% of receivables. At the end of the year, receivables amounted to £150000, but it was decided that the provision should be increased to 3% of receivables.

Which of the following set of figures would result?

The answer is:

Refer to the exhibit.

Harvey commenced business with capital of $50,000. At the end of the first financial year, he has

What was the profit for the period?

A company uses the reduced balance method of depreciation for its company vehicles. The vehicles are depreciated at a rate of 30% per annum.

On 31 March 2003 the company purchased a number of vehicles with a total cost of $200,000. The company's year-end is 31 December and it is company policy to charge a full year's depreciation in the year of acquisition.

The carrying value of the vehicles at 31 December 2006 will be