The Brookhaven Company is the parent company of two subsidiaries: an HMO and an insurance company. The headings on Brookhaven's financial statements read "Consolidated Financial Statements of Brookhaven Company." From the following answer choices, select the response that correctly indicates, under the entity concept, whether the HMO and the insurance company are accounted for as separate entities and whether the subsidiaries' financial results would be included in Brookhaven's consolidated financial statements.

The Poplar Company and a Blue Cross/Blue Shield organization have contracted to provide a typical fully funded health plan for Poplar's employees. One true statement about this health plan for Poplar's employees is that

The medical loss ratio (MLR) for the Peacock health plan is 80%. Peacock's expense ratio is 16%.

One characteristic of Peacock's MLR is that it

The following statements are about 501(c)(9) trusts. Select the answer choice containing the correct statement:

This concept, which is an extension of the going-concern concept, holds that the value of an asset that a company reports in its accounting records should be the asset's historical cost, not its current market value. Although this concept offers objectivity and reliability, it may lack relevance, particularly for assets held for a long period of time.

From the following answer choices, choose the name of the accounting concept that matches the description.

Users of the Fulcrum Health Plan financial information include:

Of these users, the ones that most likely can correctly be classified as external users with a direct financial interest in Fulcrum are the

For this question, select the answer choice containing the terms that correctly complete blanks A and B in the paragraph below. The FASB mandates that accounting information must exhibit certain qualitative characteristics. One of these characteristics is ________A________, which means that a company's financial statements use the same accounting policies and procedures from one accounting period to the next, unless there is a sound reason for changing a policy or procedure. Another characteristic is _________B________, which requires a company to disclose in its financial statements all significant financial information about the company.

In order to calculate a simple monthly capitation payment, the Argyle Health Plan used the following information:

Given this information, Argyle would correctly calculate that the per member per month (PMPM) capitation rate should be

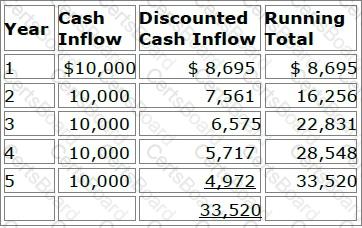

In order to print all of its forms in-house, the Prism health plan is considering the purchase of 10 new printers at a total cost of $30,000. Prism estimates that the proposed printers have a useful life of 5 years. Under its current system, Prism spends $10,000 a year to have forms printed by a local printing company. Assume that Prism selects a 15% discount rate based on its weighted-average costs of capital. The cash inflows for each year, discounted to their present value, are shown in the following chart:

Prism will use both the payback method and the discounted payback method to analyze the worthiness of this potential capital investment. Prism's decision rule is to accept all proposed capital projects that have payback periods of four years or less.

Now assume that Prism decides to use the net present value (NPV) method to evaluate this potential investment's worthiness and that Prism will accept the project if the project's NPV is greater than $4,000. Using the NPV method, Prism would correctly conclude that this project should be

Many clinicians are concerned about the development of practice guidelines that seek to define appropriate healthcare services that should be provided to a patient who has been diagnosed with a specific condition. To avoid the risk associated with using such guidelines, health plans should advise clinicians that the existence of such a guideline:

1. Establishes standards of care to be routinely utilized with all patients presenting a specific condition

2. Preempts a physician’s judgment when assessing the specific factors related to a patient’s condition