What are some of the drawbacks of correlation estimates? Which of the following statements identifies major problems with correlation calculations?

I. Correlation estimates are not able to capture increases in factor co-movements in extreme market scenarios.

II. Correlation estimates tend to be unstable.

III. Historical correlations may not forecast future correlations correctly.

IV. Correlation estimates assume normally distributed returns.

Which one of the following four statements correctly identifies disadvantages of using the economic capital?

Which one of the following is an advantage of using a daily decay factor when forecasting tomorrow’s P&L?

James Arthur is a customer of a bank who has taken a floating rate loan from the bank. He is concerned that the rates may rise in the future increasing his payment amount. Which of the following instruments should he buy to hedge against the rise in interest rates?

Which of the following statements are reasons for mathematical valuation and risk assessment models to be misleading or inaccurate?

I. There could be missing factors in models.

II. The data used as input for the model could be bad or wrong.

III. Model results could be misinterpreted.

IV. There could be errors in the derivation of the model.

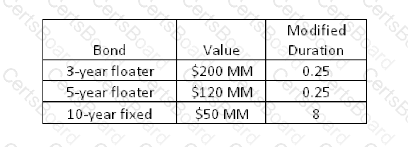

A bank owns a portfolio of bonds whose composition is shown below.

What is the modified duration of the portfolio?